The following article, written by st. louis based financial planner and founder of the chamberlin group, don chamberlin, was originally published on money.com on october 6th, 2015:

Sometimes the best money lessons come when you learn from someone else’s mistakes.

The bond between a father and son can be special. Fathers pass family traditions down with the idea that their son will maintain the legacy. However, if the family tradition is poor financial practices, it’s my job as a financial planner to step in and put a stop to those bad habits.

Some time ago, after a client’s father passed away, the client asked me to help make sense of his father’s assets. The father left his son with what he thought was a well-thought-out legacy, but a few elements of it ended up leaving the son extremely confused.

Reviewing the father’s assets, I realized he was a perpetual investor in certificates of deposit. The son explained that his dad would go online to find the state that offered the best interest rates, and he would open an account with a bank there and invest in a CD.

While this may have seemed like a smart strategy, the father didn’t keep accurate records of each of his accounts.

In fact, the son couldn’t even figure out how many CD accounts his father had opened up; he only learned about each of them as he received his father’s statements in the mail. To make the son’s life easier, I advised him to keep the estate open for at least a full year, while these surprise statements trickled in.

The father also had the foresight to establish a trust to hold the CDs, but he didn’t properly title all his assets. So two of the 12 CDs he turned out to have owned at his death had to go through the probate process.

Ultimately, much of the savings and earned interest in the father’s rate-hunting portfolio was wiped out by his estate planning mistakes. The legal fees associated with probate ate into the the two incorrectly titled accounts. So much for avoiding probate.

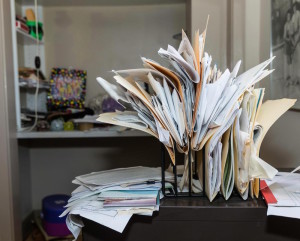

An Organized Legacy

Despite seeing his father’s mistakes, the son wasn’t sure how he could do it better. As a father himself, he wanted to ensure his family wouldn’t go through the same difficult experience in the future, so he came to me later for help.

I advised him to open his own trust to pass all his assets to his children outside of probate, and I made sure he worked with an attorney who could advise him how to title his family’s assets correctly. Then I helped create organized records in a “Family Estate Organizer” binder that compiled important legal, financial, and other estate planning information–everything from account statements to a personal belongings inventory.

We also prepared for his wife documentation on what to do in the event of his death. This “Survivor’s Checklist” gives family members guidance on the various steps of settling an estate. It’s particular helpful for surviving spouses or beneficiaries who have not been involved in deceased’s finances.

This was a crucial step for not just the son, but for his family legacy as well. He wanted to ensure he would leave his own family with a well-organized, easy-to-manage inheritance, and the binder provided just that. It allowed him to sleep better at night knowing his family could easily step in to manage the assets should the need arise.

As a financial planner, I understand a well-thought-out estate plan is a critical part of a holistic retirement plan. But I don’t think I realized how foreign this concept might be for some people until I met this client. I have since come to realize that some of the most valuable advice I have given clients is also the simplest: get organized and stay organized.

So share your plans with your loved ones and seek the assistance of a holistic adviser. You can even make it a family affair. Take the time to document your assets, then sit down with your loved ones so they can understand what you own, how it’s titled and what needs to happen as major life events take place. It will be time well spent and money well saved.

—

For the original Money.com article, please click here. To contact Don Chamberlin and The Chamberlin Group visit their website here.